Private securities are financial instruments not traded on public exchanges, encompassing private equity, private debt, and other non-public investments. These instruments provide capital to private companies and offer investors opportunities for high returns, albeit with higher risks. This article aims to shed light on the role of private securities in modern finance, discussing their benefits, challenges, and overall impact on the global economy. By understanding these dynamics, investors can make informed decisions and leverage private securities to achieve their financial goals.

Diversification and Risk Management

One of the primary benefits of private securities is their ability to diversify investment portfolios. Unlike publicly traded stocks and bonds, private securities are less correlated with market fluctuations, providing a hedge against market volatility. This diversification helps investors manage risk more effectively. For example, during market downturns, private equity and debt investments can offer stability due to their longer investment horizons and different performance drivers. This uncorrelated performance can enhance portfolio resilience and improve long-term returns. Diversifying with private securities can also include investments in niche sectors such as real estate, healthcare, or technology startups, which may not be as accessible through public markets.

Driving Innovation and Growth

Private equity and private debt play a critical role in driving innovation and economic growth. By providing capital to startups and growing companies, these investments support the development of new technologies and business models. For instance, private equity firms often invest in tech startups, enabling them to scale rapidly and bring innovative products to market. Similarly, private debt can provide necessary funding to companies that might not qualify for traditional bank loans, fostering growth in various industries. The influx of capital from private investors helps businesses expand, create jobs, and contribute to overall economic development. For example, venture capital—a form of private equity—has been pivotal in the growth of companies like Uber, Airbnb, and SpaceX, which have transformed their respective industries.

Enhancing Operational Efficiency

Private equity firms often take an active role in managing their portfolio companies, implementing strategies to enhance operational efficiency and profitability. This hands-on approach can lead to significant improvements in business performance. For example, private equity investors may streamline operations, optimize supply chains, and introduce new technologies to boost productivity. These changes not only enhance the value of the portfolio companies but also make them more competitive in the global market. The focus on operational improvements underscores the value that private equity can bring beyond mere capital investment. In many cases, private equity firms also bring in experienced executives and management teams to drive these changes, which can lead to substantial performance improvements.

Supporting Economic Resilience

Private securities contribute to economic resilience by providing a stable source of capital, especially during economic downturns. During periods of financial instability, private equity and debt can offer alternative financing solutions when traditional credit markets tighten. This stability supports businesses in navigating economic challenges and maintaining operations. For instance, during the COVID-19 pandemic, private equity firms played a crucial role in supporting businesses through financial difficulties, helping them stay afloat and recover more quickly. The ability of private securities to provide steady funding reinforces their importance in sustaining economic stability. Additionally, private equity firms often have the flexibility to adapt their investment strategies to changing economic conditions, further enhancing their resilience.

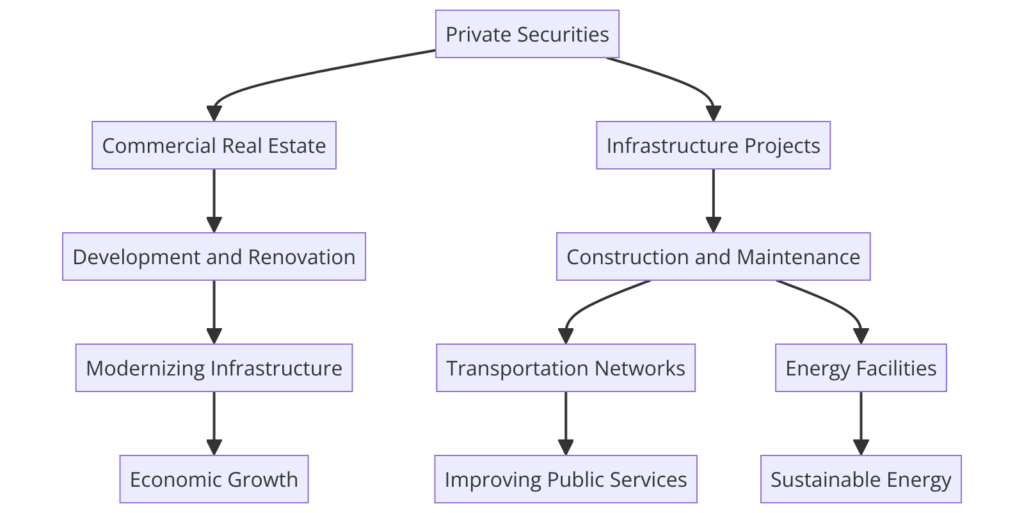

Facilitating Real Estate and Infrastructure Development

Private securities are also instrumental in real estate and infrastructure development. Private equity funds often invest in commercial real estate projects, providing capital for development and renovation. Similarly, private infrastructure funds support the construction and maintenance of essential infrastructure projects, such as transportation networks and energy facilities. These investments are crucial for modernizing infrastructure, improving public services, and supporting long-term economic growth. The capital provided by private investors enables the completion of large-scale projects that might otherwise be infeasible, contributing to societal progress. For instance, investments in renewable energy infrastructure, such as wind farms and solar power plants, are critical for transitioning to a sustainable energy future.

Challenges and Risks

Despite their benefits, private securities come with inherent challenges and risks. These include higher investment minimums, lower liquidity, and greater exposure to business-specific risks. Investors in private securities must be prepared for longer holding periods and potential difficulties in selling their investments. Additionally, the lack of transparency and regulatory oversight compared to public markets can increase the risk of fraud and mismanagement. It is crucial for investors to conduct thorough due diligence and seek professional advice when investing in private securities to mitigate these risks. Understanding the specific risks associated with different types of private securities, such as the operational risks in private equity or the credit risks in private debt, is essential for effective risk management.

The Future of Private Securities

The future of private securities looks promising, with increasing interest from institutional and individual investors. Innovations such as blockchain technology and digital assets are expected to transform the private securities market, enhancing transparency, efficiency, and accessibility. Furthermore, the growing focus on environmental, social, and governance (ESG) factors is likely to influence private investment strategies, encouraging more sustainable and responsible investing. As the market evolves, private securities will continue to play a vital role in shaping the financial landscape, offering opportunities for growth and diversification. The adoption of new technologies, such as smart contracts and tokenization, could streamline the investment process and reduce costs, making private securities more accessible to a broader range of investors.

In Conclusion

Private securities are a vital component of modern finance, offering diversification, fostering innovation, and supporting economic resilience. Despite the challenges and risks associated with these investments, their potential benefits make them an attractive option for investors seeking to enhance their portfolios. By understanding the role of private securities and staying informed about market trends, investors can capitalize on the opportunities they present and contribute to the ongoing evolution of the global financial system. As the financial landscape continues to change, private securities will remain a key driver of economic growth and development.

Thomas J Powell is Senior Advisor at The Brehon Group with over 35 years of experience in private equity, commercial banking, and asset protection. An international lecturer and policy expert, he specializes in financial structuring, asset strategies, and addressing middle-income workforce housing shortages.