The venture capital landscape is undergoing a seismic shift, thanks to the advent and integration of digital technology. This transformation has not only reshaped how venture capital operates but has also expanded the horizons for startups vying for funding. The digital age has ushered in a new era where the constraints of physical meetings and geographical boundaries are increasingly becoming relics of the past. Today, the venture capital ecosystem thrives on global connectivity, enabled by digital platforms that facilitate seamless interactions between investors and entrepreneurs from any corner of the world.

This evolution from traditional, often localized methods of securing investment to a more inclusive and accessible digital model marks a significant turning point. It opens up a wealth of opportunities for startups to secure funding, irrespective of their physical location. The transition to digital has democratized access to venture capital, allowing innovative ideas and promising startups to attract investment based on merit rather than proximity.

The objective of this article is to delve into the nuances of this transformed venture capital landscape. It aims to equip startups and entrepreneurs with the knowledge and tools necessary to successfully navigate the venture capital process in the digital age. From crafting compelling online pitches to leveraging digital platforms for networking and securing investment, the article will explore a range of strategies that startups can employ to enhance their attractiveness to venture capitalists in today’s fast-paced, digitally-driven world.

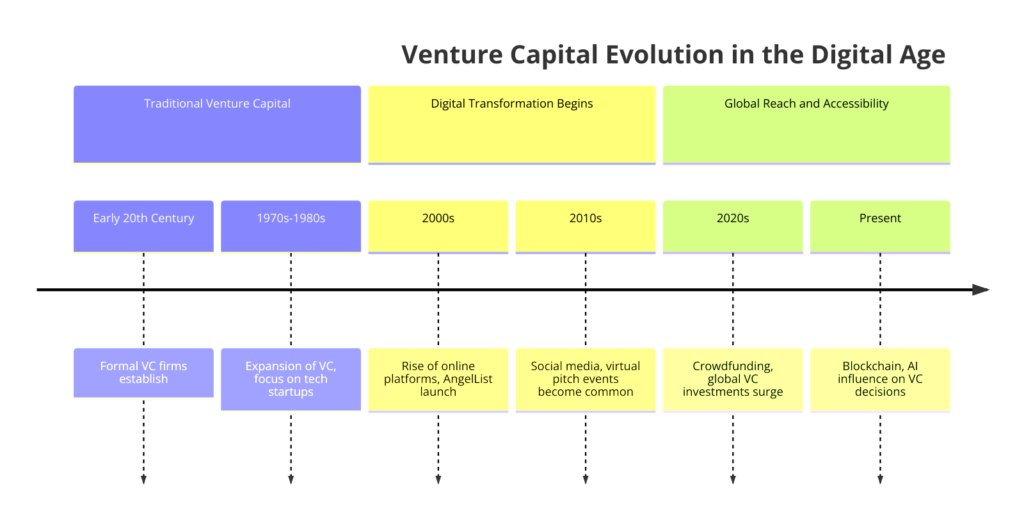

The Evolution of Venture Capital in the Digital Age

The Shift to Digital

The venture capital industry’s shift to digital has been both rapid and profound. Digital platforms, social media, and online pitch sessions have emerged as pivotal tools in the venture capital ecosystem, significantly widening the scope for startups seeking funding. This digital transformation has enabled a more efficient, streamlined process for connecting startups with potential investors. Platforms like AngelList and LinkedIn have become crucial for networking and fundraising, offering startups the ability to showcase their potential to a global audience of investors with just a few clicks.

Moreover, the rise of virtual pitch events and webinars has allowed entrepreneurs to present their ideas to investors without the need for physical travel, breaking down the barriers of distance and time. This shift not only makes the process more cost-effective for startups but also speeds up the fundraising cycle, enabling quicker decisions and potentially faster access to capital.

Global Reach and Accessibility

One of the most significant impacts of the digital age on venture capital is the elimination of geographical barriers. Startups are no longer confined to seeking investment within their local regions or countries. The global reach and accessibility afforded by digital platforms mean that a promising startup in a developing country has the potential to attract investment from top-tier venture capitalists based in Silicon Valley, London, or any other major financial hub.

This democratization of access has also benefited investors, who now have a broader pool of potential investments to consider. The ability to scout for talent and innovation on a global scale has led to more diversified portfolios and opened up new markets and opportunities that were previously inaccessible due to logistical constraints.

The digital transformation of venture capital represents a paradigm shift in how startups secure funding. It has leveled the playing field, allowing for a more inclusive, efficient, and globally connected venture capital ecosystem. As we continue to navigate this new frontier, understanding and leveraging the digital tools and platforms that facilitate these connections will be paramount for startups aiming to ride the wave of venture capital in the digital age.

Engaging with Venture Capitalists Online

Building a Digital Presence

In the digital age, a strong online presence is non-negotiable for startups seeking venture capital. Your digital footprint acts as your first point of interaction with potential investors, long before you get the chance for a face-to-face meeting. To maximize this opportunity, ensure your website is professionally designed, user-friendly, and fully encapsulates your business vision, product offerings, and the team behind your startup. It should serve as a comprehensive resource for anyone wanting to learn about your company.

Social media and professional networking sites like LinkedIn offer additional platforms to showcase your startup’s potential. Regularly update these channels with your latest achievements, press releases, and thought leadership articles to keep your audience engaged and informed. Use these platforms to tell your story, highlighting the uniqueness of your proposition and the problem you’re solving. Remember, consistency is key. A cohesive narrative across all digital platforms helps build credibility and trust with potential investors.

Pitching Online

Mastering the art of the virtual pitch is crucial in a world where digital interactions are becoming the norm. Unlike traditional pitches, virtual pitches require you to capture and maintain an investor’s attention through a screen, which can be challenging. To overcome this, focus on creating a clear, concise, and visually appealing presentation. Utilize digital tools like high-quality videos, interactive demos, and engaging visuals to bring your pitch to life. Platforms such as Zoom or Microsoft Teams allow for dynamic presentations and real-time interactions with potential investors.

Practice your pitch to ensure you’re comfortable with the technology and can handle any technical difficulties that may arise. Be mindful of your on-screen presence. Body language and eye contact (with the camera) are still important in virtual settings. Lastly, prepare for a thorough Q&A session. Anticipate questions investors may have and use this opportunity to delve deeper into your business model, market strategy, and future plans.

Embracing the Digital Shift in Venture Capital

The venture capital (VC) industry has undergone a remarkable transformation, catalyzed by the digital revolution. This journey from traditional, often localized methods of investment to a digitally-enhanced, globally accessible ecosystem signifies a new era of opportunities for startups and investors alike.

The Dawn of Digital in Venture Capital

The advent of the internet and digital platforms has fundamentally altered the landscape of venture capital, making it more efficient and expansive. Platforms such as AngelList and LinkedIn have become instrumental in bridging the gap between startups seeking funding and potential investors. The rise of virtual pitch events and webinars has further facilitated this connection, enabling entrepreneurs to present their ideas without the constraints of physical distance or geographical boundaries.

Global Reach and Democratization

The digital age has democratized access to venture capital, allowing innovative startups from any corner of the globe to attract investment based on merit rather than proximity. This shift has not only broadened the horizons for startups but also expanded the pool of opportunities for investors, who can now scout for potential investments on a global scale.

Navigating the Digital Venture Capital Landscape

For startups looking to navigate this new venture capital landscape, building a strong digital presence is paramount. Engaging with potential investors online, leveraging digital platforms for networking, and mastering the art of the virtual pitch are crucial steps in attracting digital-age VC. Moreover, understanding and adapting to the evolving digital tools and platforms that facilitate these connections will be key to success in securing venture capital in the digital age.

Top 5 Digital Platforms for Connecting with VCs

1. AngelList

AngelList stands as a pioneering platform in the startup ecosystem, seamlessly connecting startups with angel investors and venture capitalists. It offers a unique space for startups to showcase their business, attract funding, and even recruit talent. For entrepreneurs, creating a compelling profile on AngelList can be a critical step in securing early-stage funding. The platform also provides features like syndicates, where investors can pool resources to invest in startups, increasing the potential for funding.

2. Crunchbase

Crunchbase is an invaluable tool for startups looking to research potential investors, understand market trends, and keep an eye on the competition. It offers a wealth of information on companies, investors, and the broader startup ecosystem. By maintaining an updated and detailed Crunchbase profile, startups can increase their visibility among potential investors browsing the platform for new investment opportunities.

3. LinkedIn

LinkedIn’s professional network is an essential tool for startups aiming to attract venture capital. It allows founders to connect directly with investors, participate in industry discussions, and share updates about their startup’s progress. Engaging content that highlights your startup’s milestones, media mentions, and thought leadership can attract the attention of venture capitalists on the platform.

4. Kickstarter/Indiegogo

For startups in product-based industries, crowdfunding platforms like Kickstarter and Indiegogo offer an alternative avenue to complement traditional venture capital efforts. These platforms allow you to validate your product in the market, gather early adopters, and demonstrate consumer interest to potential investors. Successful crowdfunding campaigns can also serve as a powerful proof of concept when engaging with venture capitalists.

5. VC Firm Websites and Portals

Many venture capital firms have their own digital portals for startup submissions. These platforms are an opportunity for direct engagement with VCs, bypassing traditional networking routes. When submitting through these portals, ensure your application is thorough, professional, and tailored to the specific interests and investment thesis of the VC firm. An impactful submission should clearly articulate your value proposition, market opportunity, and traction to date.

Navigating the venture capital landscape in the digital age requires startups to be proactive, strategic, and savvy about utilizing online platforms and tools. By effectively building a digital presence, mastering online pitching techniques, and leveraging key digital platforms, startups can enhance their visibility and attractiveness to venture capitalists, opening up new avenues for funding and growth.

The Digital Transformation of Venture Capital

Innovative Funding Models

The venture capital industry is witnessing a revolution, fueled by the advent of digital technology that has introduced innovative funding models reshaping how startups secure financial backing. Equity crowdfunding has emerged as a powerful tool, democratizing access to capital by allowing a wide array of investors to contribute towards startup funding in exchange for equity. This model has opened new doors for startups that may not fit the traditional venture capital mold, offering them a platform to connect with potential investors worldwide.

Tokenization, leveraging blockchain technology, presents another frontier in venture capital. By converting assets into digital tokens, startups can offer fractional ownership, enhancing liquidity and accessibility for investors. This model not only simplifies the investment process but also broadens the investor base to include those who might be interested in smaller stakes, making it particularly appealing for ventures with high growth potential.

Revenue-sharing models are also gaining traction, offering an alternative to equity-based financing. In this arrangement, investors receive a proportion of the company’s future revenues in exchange for capital, aligning the success of the business with the returns to investors. This model is especially attractive for businesses with clear revenue trajectories but who wish to retain control over equity.

The Role of Data in VC Decisions

In the digital age, venture capitalists are increasingly relying on data analytics and digital tools to inform their investment decisions. The ability to analyze vast amounts of data on market trends, consumer behavior, and startup performance has provided VCs with deeper insights, enabling more informed and strategic investment choices. Digital platforms that offer real-time data and predictive analytics are becoming indispensable in the VC toolkit, helping to identify promising investment opportunities and assess risks more accurately.

Future Trends in Digital Age VC

Looking ahead, the venture capital landscape is set to be further transformed by emerging technologies such as artificial intelligence (AI) and blockchain. AI is expected to play a significant role in automating due diligence processes, enhancing deal sourcing efficiency, and providing predictive insights into startup success. Blockchain technology, beyond its role in tokenization, promises to bring greater transparency and security to VC transactions.

The integration of these technologies into the venture capital process will not only streamline operations but also open up new avenues for innovation in funding models and investment strategies. As the digital transformation of venture capital continues to unfold, startups and investors alike must stay attuned to these trends, ready to adapt to the evolving landscape.

Some FAQs Answered on The Relevant Topic

How can I make my startup more attractive to digital-age VCs?

To appeal to digital-age venture capitalists, startups need to emphasize their digital savviness, market potential, and scalability. Building a strong online presence, showcasing your innovation through digital platforms, and demonstrating a clear understanding of your target market are key. Additionally, having a solid grasp of how emerging technologies can be leveraged for growth can set you apart.

What are the key elements of a successful online pitch to venture capitalists?

A successful online pitch to venture capitalists should be concise, compelling, and visually engaging. It must clearly articulate your value proposition, the problem you’re solving, your business model, and your market potential. Utilizing digital tools to create interactive presentations or demos can also help in making a lasting impression.

How important is a digital footprint in securing venture capital?

A robust digital footprint is increasingly crucial in securing venture capital, as it reflects your startup’s brand visibility, engagement, and operational maturity. A strong digital presence on professional networking sites, industry forums, and social media can significantly enhance your startup’s attractiveness to potential investors.

What are the pitfalls to avoid when seeking VC funding online?

When seeking VC funding online, avoid overreaching without a solid business plan, neglecting the importance of networking, and underestimating the need for a clear digital strategy. It’s also crucial to be wary of sharing sensitive information without adequate protection or agreements in place.

Conclusion: Mastering the Digital Venture Capital Wave

Embracing the digital transformation of venture capital is no longer optional for startups and entrepreneurs aiming for success in today’s competitive landscape. The insights and strategies explored in this article underscore the pivotal role of digital technology in revolutionizing how venture capital operates. By adapting to these changes, engaging effectively online, and leveraging digital platforms, startups can significantly enhance their prospects for securing venture capital. The future of funding lies in the digital realm, and mastering this wave is essential for any entrepreneur looking to navigate the venture capital process successfully.

Thomas J Powell is Senior Advisor at The Brehon Group with over 35 years of experience in private equity, commercial banking, and asset protection. An international lecturer and policy expert, he specializes in financial structuring, asset strategies, and addressing middle-income workforce housing shortages.