The landscape of raising capital is undergoing a transformative shift, propelled by the rapid pace of technological innovation and changes in the global financial ecosystem. Today’s entrepreneurs and business owners find themselves exploring beyond the traditional pathways of securing funding, venturing into territories enriched by digital platforms, blockchain technology, and a more democratized approach to investment. This evolution in fundraising reflects a broader change in the financial world, where diversity in funding strategies is not just welcome but necessary for growth and sustainability.

The movement towards innovative and varied fundraising strategies is driven by a confluence of factors. Technological advancements have unlocked new possibilities for connecting with potential investors, while changing investor mindsets have opened doors to more experimental and risk-tolerant forms of capital. Moreover, the globalization of the economy means that businesses are no longer confined to their local markets for funding; they can tap into international pools of capital that were previously inaccessible.

This article aims to delve deep into the nuances of this changing landscape, offering a comprehensive exploration of both time-honored and avant-garde methods of raising capital. By shedding light on these diverse strategies, we hope to provide valuable insights for businesses looking to navigate the complex and dynamic world of fundraising, ultimately empowering them to fuel their growth in innovative and effective ways.

Traditional vs. Modern Fundraising Landscapes

Understanding the Basics

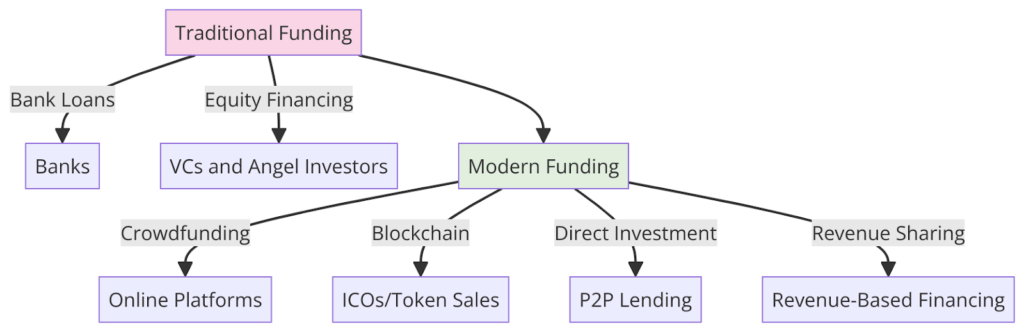

At the foundation of business financing lie the traditional sources of capital: banks, venture capital (VC), and angel investors. These avenues have long served as the backbone of funding for businesses at various stages of growth. Bank loans, with their structured repayment terms and interest rates, have been a go-to for businesses looking for debt financing. On the equity side, venture capital firms and angel investors offer funding in exchange for ownership stakes, bringing not only capital but also valuable expertise and networks to the table. These traditional methods, while still prevalent, require rigorous due diligence, significant collateral, or giving up a portion of business control.

The Rise of Alternative Funding

As we step into the modern era of fundraising, a new spectrum of alternative funding methods has emerged, challenging the dominance of traditional routes. Crowdfunding platforms, for instance, have democratized access to capital, allowing businesses to raise funds directly from the public through small contributions from a large number of individuals. This method not only provides the necessary financial backing but also builds a community of supporters around a business.

Initial Coin Offerings (ICOs) represent another frontier in fundraising, merging finance with the revolutionary technology of blockchain. By offering digital tokens to investors, businesses can raise capital without diluting equity or taking on debt, all while potentially gaining rapid access to a global pool of funds. However, ICOs come with their own set of regulatory, security, and market risks that businesses need to navigate carefully.

Revenue-based financing is gaining traction as a viable alternative for businesses with steady revenue streams but who are wary of relinquishing equity. This model allows companies to repay borrowed funds as a percentage of their revenue, aligning the financing cost directly with their financial performance. It offers the flexibility and scalability that many growing businesses seek, without the long-term commitments or loss of control associated with equity financing.

The fundraising landscape is more diverse and accessible than ever, thanks to the advent of these modern methodologies. As businesses venture beyond traditional funding sources, they unlock new opportunities for growth, innovation, and community building. However, navigating this complex terrain requires a deep understanding of the advantages and challenges associated with each method, a theme we will continue to explore throughout this article.

Leveraging Technology for Fundraising

Crowdfunding Success

Crowdfunding has revolutionized the way entrepreneurs and startups raise capital, democratizing access to funding by allowing individuals to contribute small amounts towards a collective goal. To launch a successful crowdfunding campaign, start by crafting a compelling narrative that clearly communicates your project’s vision, goals, and the impact it aims to achieve. High-quality visuals and videos can significantly enhance your campaign’s appeal, making your proposition more engaging and understandable. Setting realistic funding targets, offering attractive rewards, and actively promoting your campaign across social media and other digital platforms are crucial steps. Engagement doesn’t end once the campaign is live; maintaining open communication with backers, providing regular updates, and expressing gratitude for their support are key to building lasting relationships and potentially securing future funding.

Navigating the World of ICOs

Initial Coin Offerings (ICOs) offer a novel way to raise capital through the sale of digital tokens, leveraging blockchain technology. Successful ICOs require meticulous planning, starting with a clear and detailed whitepaper that outlines the project’s objectives, technology, tokenomics, and the use of funds. Ensuring legal compliance is paramount, as regulatory scrutiny around ICOs is increasing globally. Building a robust, secure, and scalable platform is essential to gain investors’ trust. Marketing your ICO effectively involves engaging with the crypto community, utilizing social media, and possibly partnering with influencers in the blockchain space. Transparency, regular updates, and a solid post-ICO plan for project development and token utility are critical for sustaining investor interest and support.

Online Lending Platforms

Online lending platforms have emerged as a fast and efficient alternative to traditional bank loans, harnessing fintech innovations to offer businesses quicker access to capital. To leverage online lending platforms, begin by researching and comparing different lenders to find the best rates and terms that suit your business needs. Ensure your business financials are in order, including detailed revenue reports and cash flow statements, as these will be crucial in the application process. Applying for a loan through an online platform typically involves filling out a digital application and submitting the necessary financial documents. The use of technology in these platforms often means quicker decision times, and if approved, funds can be available in a matter of days. It’s important to carefully read the terms and conditions, understanding the repayment schedule, interest rates, and any fees associated with the loan.

The Evolution of Fundraising: Embracing New Horizons

The journey of fundraising is witnessing a pivotal transformation, marked by the integration of digital innovations and a growing preference for more democratized funding avenues. This transition from traditional sources such as banks and venture capitalists to modern platforms including crowdfunding, ICOs, and peer-to-peer lending reflects a significant shift in how businesses approach capital raising in the digital era.

From Tradition to Innovation

The bedrock of business financing has historically relied on traditional institutions like banks for loans and venture capitalists for equity investments. These channels, while effective, often presented barriers to entry for many startups and small businesses due to stringent requirements and the potential relinquishment of control.

A New Era of Fundraising

The advent of digital technology has ushered in a new age of fundraising, characterized by accessibility, flexibility, and a global reach. Crowdfunding platforms empower businesses to garner support from a wide audience, enabling them to secure funding through small contributions from numerous backers. Similarly, the emergence of blockchain technology and ICOs offers a novel mechanism for raising capital without equity dilution, appealing to a tech-savvy investor base across the globe.

Leveraging Modern Platforms for Growth

Today’s entrepreneurs are increasingly leveraging these modern platforms to circumvent the limitations of traditional fundraising. By embracing these innovative methods, businesses can access a broader spectrum of investment opportunities, engage with their supporter community more directly, and retain greater control over their operations.

Navigating the Future of Fundraising

As the landscape continues to evolve, understanding the nuances of each funding method becomes paramount. Businesses must navigate the benefits and challenges of these diverse strategies, from the expansive potential of crowdfunding and the cutting-edge appeal of ICOs to the tailored solutions offered by revenue-based financing.

The diagram above encapsulates this dynamic shift, illustrating the journey from conventional funding pathways to a future where digital platforms and blockchain technology play a central role in connecting entrepreneurs with the capital they need to thrive. In embracing these modern methods, businesses are not only securing the necessary funds for growth but are also aligning themselves with the changing preferences and values of a new generation of investors.

5 Unconventional Ways to Raise Capital

1. Peer-to-Peer Lending

Peer-to-peer (P2P) lending bypasses traditional financial intermediaries by connecting borrowers directly with individual lenders through online platforms. This method can offer more flexible terms and lower interest rates than traditional loans. To access P2P lending, businesses should create compelling loan listings that highlight their financial stability, growth potential, and what the funds will be used for. Creditworthiness still plays a significant role, so maintaining a strong business credit score is important.

2. Revenue-Based Financing

Revenue-based financing is a flexible alternative that aligns funding amounts with your company’s revenue, ideal for businesses with fluctuating income. In this model, repayments are tied to monthly sales, rising and falling accordingly. This flexibility can be especially advantageous for businesses in seasonal industries or those experiencing rapid growth. To secure revenue-based financing, companies should demonstrate strong revenue generation and the potential for continued growth.

3. Bootstrap Funding

Bootstrap funding involves using personal resources or operating revenues to fund your business. This approach emphasizes minimal reliance on external funding, promoting frugality, and reinvesting profits back into the business. Successful bootstrapping requires careful financial management, prioritizing essential spending, and finding cost-effective solutions to business needs. It allows entrepreneurs to maintain control over their business but requires discipline and a willingness to assume personal financial risk.

4. Incubators and Accelerators

Incubators and accelerators provide not just capital but also mentorship, resources, and networking opportunities to help startups grow. To benefit from these programs, businesses must have a strong, scalable business idea and be willing to undergo a competitive application process. Participation often involves working closely with mentors, refining business models, and preparing pitches for potential investors. These programs can be a significant springboard for early-stage companies looking to fast-track their growth.

5. Government Grants and Subsidies

Government grants and subsidies represent a form of funding that doesn’t require repayment, making them highly attractive. These funds are often earmarked for businesses operating within specific industries, regions, or focusing on particular technological innovations or social objectives. Securing a grant or subsidy typically involves a detailed application process, demonstrating how the project aligns with the funding body’s objectives. Businesses may need to provide detailed project descriptions, budget forecasts, and impact assessments. While the process can be competitive and time-consuming, the non-repayable nature of these funds makes them an appealing option for eligible businesses.

By exploring these innovative and unconventional methods of raising capital, businesses can find new pathways to funding that align with their unique needs and growth stages. Whether through leveraging technology, tapping into alternative financing models, or utilizing support systems designed for startups, there are more options than ever for businesses looking to fuel their next phase of growth.

The Future of Funding

Emerging Trends in Raising Capital

The future of funding is being dramatically reshaped by technological advancements and significant economic shifts, introducing a new era of innovation in raising capital. The digitization of finance has opened up unprecedented avenues for businesses to secure funding, with platforms and technologies enabling more direct connections between entrepreneurs and investors. Crowdfunding, once considered a niche option, has burgeoned into a mainstream funding mechanism, thanks to its ability to aggregate small investments from a broad audience. Similarly, blockchain technology and the advent of initial coin offerings (ICOs) and security token offerings (STOs) have introduced a new paradigm in asset liquidity and investor engagement. These trends signal a move towards more inclusive, democratized, and flexible funding ecosystems.

The Role of Digital Assets in Fundraising

Digital assets, particularly cryptocurrencies and tokens, are playing an increasingly pivotal role in fundraising. The blockchain technology underlying these assets offers transparency, security, and efficiency—qualities that traditional funding mechanisms often lack. By tokenizing assets, companies can fractionalize ownership and offer it to a global pool of investors, potentially increasing liquidity and accessibility. However, navigating this landscape requires a deep understanding of regulatory environments, which vary significantly across jurisdictions. As blockchain technology matures and regulatory frameworks evolve, digital assets are expected to become a more integral part of fundraising strategies.

Sustainability and Social Impact Investing

Sustainability and social impact investing are no longer niche considerations but central components of many investors’ decision-making processes. The growing emphasis on environmental, social, and governance (ESG) criteria reflects a broader societal shift towards sustainability and ethical business practices. Investors are increasingly looking for opportunities that not only promise financial returns but also contribute positively to societal and environmental outcomes. This shift is prompting businesses to integrate ESG principles into their operations and fundraising narratives, aligning their goals with the values of socially conscious investors.

Some FAQs Answered on The Relevant Topic

How do I determine which fundraising method is right for my business?

Determining the right fundraising method involves evaluating your business’s stage, goals, and financial health. Startups might lean towards equity financing or crowdfunding to not burden their nascent operations with debt, while more established businesses may consider loans or revenue-based financing. Understanding the nuances of each option and how they align with your business model and growth objectives is crucial.

What are the key considerations when preparing for a fundraising round?

When preparing for a fundraising round, consider your valuation, the amount of capital to raise, and the impact on ownership and control. A well-articulated business plan, clear financial projections, and a compelling pitch are essential. Additionally, ensure your business’s legal and financial documentation is in order, as transparency and professionalism significantly influence potential investors’ decisions.

How can I make my business more attractive to investors?

Making your business attractive to investors involves demonstrating a clear value proposition, a scalable business model, and a capable management team. Solid growth metrics, a sustainable competitive advantage, and a clear path to profitability can also increase attractiveness. Engaging storytelling that connects your business’s mission with broader market or societal trends can further captivate potential investors.

What are the potential risks associated with different types of fundraising?

Each fundraising method comes with its own set of risks. Equity financing can dilute ownership and control, while debt financing requires repayment regardless of business performance. Crowdfunding and ICOs may lead to public scrutiny and regulatory challenges. Understanding these risks and preparing mitigation strategies is essential for a successful fundraising endeavor.

Conclusion: Charting Your Path to Fundraising Success

The landscape of fundraising is evolving, with new technologies, investor preferences, and economic realities shaping the ways in which businesses secure capital. This article has explored a range of innovative strategies and insights, from leveraging technology in crowdfunding and ICOs to engaging with the burgeoning fields of sustainability and social impact investing. As we look towards the future, it’s clear that flexibility, creativity, and strategic planning are key to navigating this complex landscape. Businesses that adapt to these changes, aligning their fundraising efforts with both traditional and modern avenues, will be best positioned to capitalize on the opportunities of this new era of funding. Embracing these diverse strategies not only opens up new avenues for capital but also aligns businesses with the evolving expectations of investors and society at large, setting the stage for long-term success and growth.

Thomas J. Powell is a distinguished Senior Advisor at Brehon Strategies and a recognized figure in the realm of entrepreneurship and private equity. His journey in the financial services and banking sector, starting in 1988 in Silicon Valley, spans more than 35 years and is marked by profound industry expertise. Powell’s dual citizenship in the European Union and the United States empowers him to adeptly steer through international business landscapes. Currently studying for his Doctor of Law and Policy at Northeastern University, his research is centered on addressing the shortage of middle-income workforce housing in rural resort areas. Alongside his professional pursuits, he remains committed to community enrichment, illustrated by his 45-year association with the Boys and Girls Clubs of America. Follow Thomas J Powell on Twitter, Linkedin etc.