Embarking on an entrepreneurial journey brings not only opportunities for growth and success but also significant financial risks. Protecting your assets, both business and personal, is crucial in safeguarding your financial health against potential legal challenges and liabilities. Asset protection isn’t just about risk aversion; it’s about ensuring the longevity and stability of both your business ventures and personal financial well-being.

Entrepreneurs often face a myriad of financial and legal risks that can threaten their business operations and personal assets. These risks can range from lawsuits and debts to compliance failures and contractual disputes. Each of these elements has the potential to not only disrupt business operations but also impact personal financial stability if not properly managed through effective asset protection strategies.

This article aims to equip new entrepreneurs with the necessary insights and strategies to integrate asset protection into their business planning effectively. By the end, you should understand the critical importance of safeguarding assets and be prepared with practical approaches to mitigate risks right from the start of your entrepreneurial journey.

The Basics of Asset Protection

Understanding Asset Protection

Asset protection is the strategic structuring of your business and personal finances in a way that minimizes risk exposure to potential lawsuits, creditors, or financial downturns. Effective asset protection ensures that in the face of adversity, the personal and business assets are shielded from devastating legal judgments or debts, securing the long-term viability of the entrepreneur’s financial health.

Legal Structures for Protection

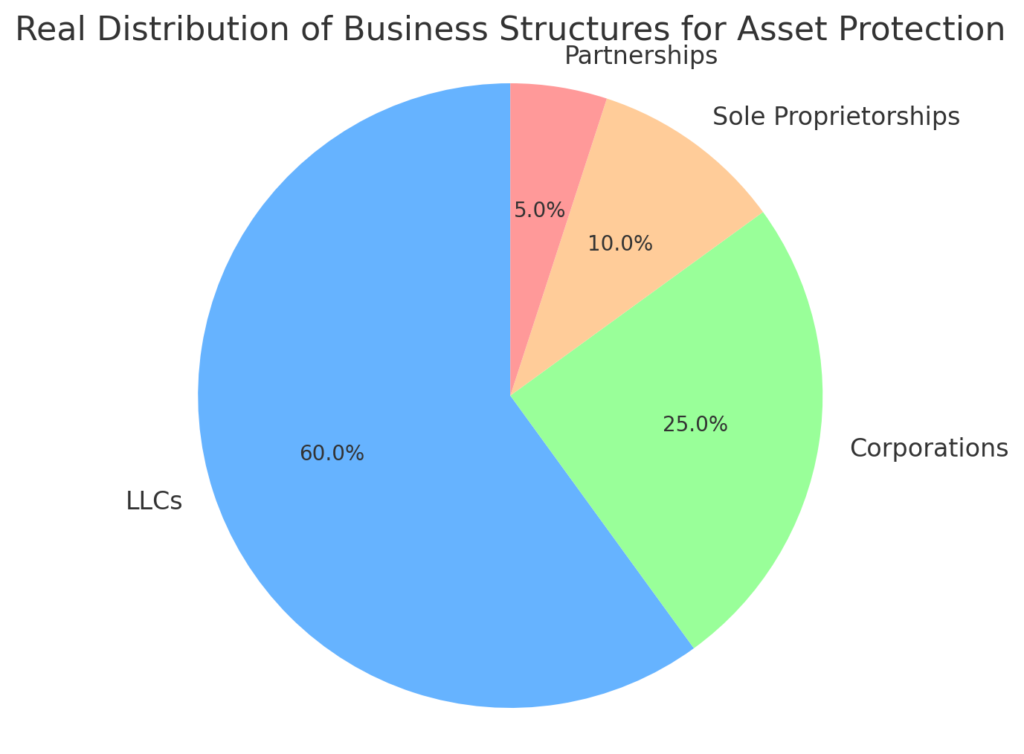

Choosing the right business structure is a foundational step in asset protection. Structures such as Limited Liability Companies (LLCs), S corporations, and partnerships offer different levels of protection, tax benefits, and operational flexibilities. For example, LLCs are highly favored for providing a legal barrier that separates personal assets from business debts and liabilities, thereby preventing personal financial exposure from business risks.

Strategic Business Planning

Choosing the Right Business Structure

Selecting the appropriate business entity is crucial for asset protection and can significantly impact your liability and tax obligations. The choice between an LLC, S Corporation, or Partnership should be guided by your business’s specific needs and exposure to risks. For instance, an LLC is often recommended for businesses seeking flexibility and protection of personal assets from business liabilities, as it offers a legal shield that separates personal finances from business debts.

Operational Strategies to Limit Liability

To further safeguard your enterprise, implementing sound operational strategies is key. This includes employing practices that ensure compliance with employment laws, securing contracts that clearly outline terms and conditions, and maintaining high standards in product safety to avoid negligence claims. Each of these practices not only helps in limiting liability but also fortifies your business’s foundation against potential legal threats.

Financial Management and Separation

Keeping Business and Personal Finances Separate

One of the fundamental rules of business finance is to keep personal and business finances separate. This separation is achieved by setting up distinct bank accounts and credit lines for the business, which not only simplifies accounting and tax reporting but also protects personal assets from business creditors. Maintaining this separation is essential for asset protection and is often required by law to preserve the liability protections offered by your business structure.

Insurance as a Safety Net

Adequate insurance coverage acts as a critical safety net, protecting both your business and personal assets. Key policies to consider include general liability insurance, professional liability insurance, and property insurance, each tailored to cover different aspects of business risks. Additionally, personal umbrella policies can provide extra coverage beyond standard limits, ensuring comprehensive protection against potential lawsuits or disasters.

Legal Compliance and Documentation

Importance of Legal Compliance

Adhering to laws and regulations is not only a legal requirement but a strategic defense mechanism for asset protection. Compliance with business operations, environmental laws, and financial regulations helps prevent legal challenges that could threaten your business. Regular legal audits can help identify areas of potential risk, allowing for timely corrections and ensuring ongoing compliance.

Keeping Accurate Records

Accurate and thorough record-keeping supports your compliance efforts and helps establish a clear boundary between business and personal assets. Keeping detailed records of transactions, agreements, and business decisions is essential for tracking the financial health of your business, supporting claims for deductions, and proving compliance in audits. This practice not only helps in asset protection but also enhances the overall management and operational transparency of your business.

Advanced Asset Protection Strategies

Using Trusts and Other Legal Tools

Trusts and other legal tools offer sophisticated means to manage and safeguard assets more effectively, particularly for entrepreneurs who wish to ensure long-term protection. Establishing a trust can help isolate assets from potential creditors and legal disputes, ensuring that personal wealth is shielded from business liabilities. Trusts can be especially beneficial for estate planning, helping to ensure that assets are distributed according to the entrepreneur’s wishes without exposure to probate or external claims.

Strategies for Multiple Business Ventures

For entrepreneurs involved in multiple business ventures, it is crucial to structure each enterprise in a manner that minimizes cross-liability. This means setting up separate legal entities for each business to ensure that financial troubles or legal issues in one venture do not spill over to others. Such segmentation may involve multiple LLCs or corporations, each with its own records and financial statements, to maintain clear boundaries between each business activity.

Reviewing and Updating Asset Protection Measures

Regular Reviews

Asset protection is not a set-it-and-forget-it strategy. Regularly reviewing and updating your asset protection plans is essential to accommodate business growth, changes in the law, and shifts in your personal life. Periodic reviews allow you to adjust strategies in response to new risks or opportunities, ensuring that your asset protection measures evolve in step with your business and personal circumstances.

Professional Advice

Consistent consultation with legal and financial advisors is vital to maintain effective asset protection strategies. These professionals can provide crucial insights into recent legal developments, advise on the impact of new regulations, and help recalibrate your asset protection strategies to ensure they remain robust and responsive to current needs.

In Conclusion

Throughout this article, we’ve explored a range of strategies that are essential for safeguarding the assets of entrepreneurial ventures. From choosing the right business structure and maintaining separate financial identities to utilizing advanced legal tools and regularly updating protection measures, these strategies form the backbone of effective asset protection. As you move forward, remember the importance of staying proactive and informed about asset protection trends and legal changes. By doing so, you can ensure that both your personal and business assets are secured against potential threats, allowing you to focus on what you do best—growing your business and achieving your entrepreneurial goals. This journey requires diligence and adaptability, but with the right approaches and expert advice, you can protect your hard-earned assets and ensure the longevity and success of your ventures.

Thomas J Powell is Senior Advisor at The Brehon Group with over 35 years of experience in private equity, commercial banking, and asset protection. An international lecturer and policy expert, he specializes in financial structuring, asset strategies, and addressing middle-income workforce housing shortages.