In the intricate world of finance, wealth management stands as a critical domain, continually adapting to the dynamic and often complex global legal environment. As countries evolve their legal frameworks, wealth management practices must pivot accordingly, navigating these changes with precision and foresight. This aspect of wealth management is not just about safeguarding assets but also about seizing opportunities that arise from legal shifts.

The significance of legal nuances in wealth management cannot be overstated. Understanding and adeptly navigating these nuances is paramount for both wealth managers and clients. Changes in tax laws, estate planning regulations, and international financial guidelines directly impact investment strategies and wealth preservation. In this article, we delve into the intricate relationship between wealth management and the legal landscape, exploring how one influences and shapes the other.

Our objective is to shed light on the multifaceted nature of legal considerations in wealth management. From dissecting tax laws to unraveling estate planning complexities, we aim to provide valuable insights into how legal changes can sculpt wealth management strategies. This exploration is designed to equip investors and financial professionals with the knowledge to make informed decisions, ensuring their wealth management approaches are both legally compliant and strategically sound in a changing world.

Understanding the Legal Landscape in Wealth Management

In the realm of wealth management, legal considerations form the backbone of effective strategy formulation and implementation. The legal landscape here is vast, encompassing a range of areas from domestic tax laws to international financial regulations.

Key Legal Considerations in Wealth Management

- Tax Laws: One of the most significant legal areas in wealth management is tax legislation. Changes in tax laws can have profound implications on investment decisions, asset allocations, and wealth preservation tactics. Understanding these laws, both at a national and international level, is crucial for effective wealth management.

- Estate Planning: Another critical area is estate planning. Legal intricacies in estate laws can influence how wealth is preserved and transferred across generations. Navigating these laws requires not just legal expertise but also strategic foresight to ensure wealth protection and continuity.

- International Regulations: With the globalization of finance, international regulations have become increasingly important in wealth management. Compliance with cross-border financial laws and understanding the implications of international tax treaties are essential for managing global investments. This includes adhering to regulations like the Foreign Account Tax Compliance Act (FATCA) and understanding the legalities of offshore investments.

Impact of Legal Changes on Wealth Management

Legal changes can dramatically reshape wealth management strategies. For instance, alterations in tax legislation might shift the attractiveness of certain investment vehicles, prompting a reassessment of asset allocation. Similarly, updates in estate planning laws could necessitate revisions in wealth transfer strategies to ensure compliance and optimize tax efficiency.

The ever-evolving legal landscape requires wealth managers and clients to stay informed and agile. A proactive approach to understanding and adapting to these changes is key. It involves continuous education, consultation with legal experts, and a keen eye on both domestic and international legal developments. In this complex interplay between law and finance, staying ahead of legal changes is not just about risk mitigation; it’s about capitalizing on new opportunities and safeguarding assets in a compliant and strategic manner.

Adapting Wealth Management Strategies

In the ever-evolving realm of wealth management, adapting strategies to align with legal changes is a critical task for ensuring both compliance and effectiveness. The first crucial step in this adaptive process involves staying informed about legal developments. This can be achieved through a variety of means such as subscribing to relevant financial news, participating in industry seminars, or engaging with legal experts. Being well-informed is vital as it allows wealth managers and clients to anticipate changes and strategically plan their responses.

Once new legal developments are identified, the next step is to assess their impact on current wealth management strategies. This necessitates a detailed analysis that can range from understanding how changes in tax laws might affect investment returns to how amendments in estate laws could influence wealth transfer plans. It’s essential for wealth managers to review and analyze these aspects meticulously.

After identifying the potential impacts, consulting with legal and financial experts becomes indispensable. These professionals can offer invaluable insights into the intricacies of new laws and help in re-evaluating and adjusting current strategies. Their expertise ensures that any strategy modifications are both legally sound and financially prudent.

Subsequently, revising investment plans and strategies is imperative. Depending on the nature of the legal changes, this might involve reallocating assets, exploring different investment vehicles, or adjusting the overall risk management approach to ensure alignment with new legal requirements. The goal is to adapt strategies in a way that they continue to meet the clients’ financial goals while remaining compliant with the updated legal framework.

Implementing these revised strategies is a critical step. It requires effective communication with all stakeholders to ensure they understand the reasons behind the changes and the expected outcomes. This clarity is essential for maintaining trust and ensuring seamless execution of the new strategies.

Lastly, the legal environment is dynamic, and hence, wealth management strategies should be flexible and adaptable to future changes. Continuous monitoring of both the legal landscape and the performance of implemented strategies is essential. This ongoing vigilance and adaptability are crucial for the long-term success and legality of wealth management practices.

Navigating through the complexities of legal changes in wealth management demands a proactive, informed, and flexible approach. By diligently staying informed, consulting with experts, revising plans, and implementing adaptable strategies, wealth managers can effectively navigate these changes, safeguarding their clients’ assets and ensuring the continued success of their financial plans.

2023 Wealth Management Landscape: Adapting to New Trends and Challenges

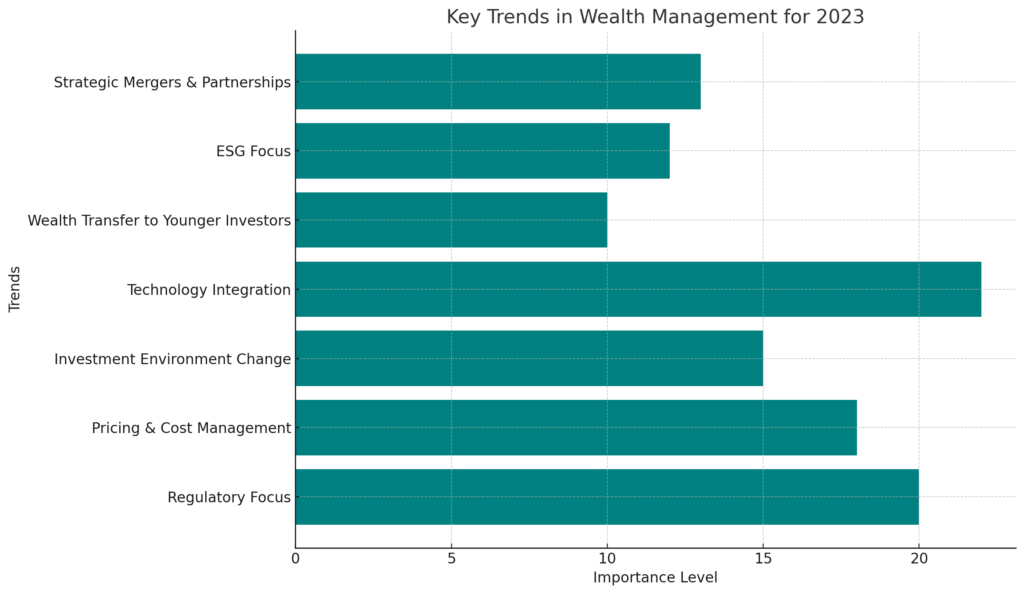

The bar chart above represents the key trends shaping the wealth management industry in 2023, each with its respective importance level. These trends highlight the dynamic and multifaceted nature of the industry, emphasizing the need for wealth managers to adapt and evolve in response to these changing factors.

Regulatory Focus: The highest importance is placed on regulatory focus, signifying the critical role of adapting to evolving regulatory frameworks. Wealth managers are required to stay abreast of and comply with new regulations, particularly in sustainable finance and investor protection.

Technology Integration: Another significant trend is technology integration, including the use of AI and blockchain. This technology is essential for improving operational efficiency, enhancing client experiences, and navigating complex investment landscapes.

ESG Focus: The growing emphasis on Environmental, Social, and Governance (ESG) factors reflects the industry’s shift towards sustainable and responsible investment practices. It aligns with the rising investor and societal expectations around ethical investing.

Strategic Mergers & Partnerships: The trend towards mergers and strategic partnerships indicates a strategic approach to growth and expansion in the industry. These alliances are crucial for accessing new asset classes, investor segments, and creating scale and efficiencies.

Investment Environment Change: Changes in the investment environment, including shifts in market outlook and asset allocation, require wealth managers to reassess their strategies to continue delivering value to clients.

Pricing & Cost Management: The focus on pricing and cost management highlights the need for sustainable revenue models in the face of economic challenges and client profitability concerns.

Wealth Transfer to Younger Investors: The anticipated transfer of wealth to younger investors with different investment philosophies necessitates a strategic reorientation to cater to these emerging client segments.

The chart not only provides a visual representation of these priorities but also serves as a strategic guide for wealth managers. Embracing these trends will be crucial for firms seeking to stay competitive, resilient, and aligned with evolving market expectations and client needs in 2023 and beyond. As the wealth management landscape continues to evolve, these trends underscore the importance of being agile, informed, and technologically adept.

Top 5 Challenges in Wealth Management and Legal Compliance

Wealth management faces numerous challenges, especially when it comes to legal compliance. Here are the top five challenges and their implications:

- Navigating International Tax Laws and Regulations: With the increasing globalization of wealth, understanding and complying with international tax laws is a significant challenge. This includes managing the implications of cross-border investments and adhering to international tax treaties.

- Managing Risks in Estate Planning and Inheritance Laws: Estate planning and inheritance laws can be complex and varied, especially across different jurisdictions. Ensuring compliance while optimizing wealth transfer requires careful planning and an understanding of the legal nuances in each relevant jurisdiction.

- Compliance with Evolving Financial Regulations: Financial regulations are continually evolving, and keeping up with these changes is crucial for legal compliance in wealth management. This includes regulations related to investments, reporting requirements, and ethical standards.

- Dealing with Privacy and Data Protection Laws: With the increasing focus on data security, wealth managers must navigate privacy and data protection laws. This involves ensuring that client data is handled securely and in compliance with laws such as the General Data Protection Regulation (GDPR).

- Understanding the Implications of Political and Economic Changes: Political and economic shifts can have significant implications for wealth management. This includes changes in government policies, economic sanctions, and fluctuations in currency values. Understanding these factors is essential for strategic planning and risk management.

Each of these challenges requires a strategic approach and a deep understanding of the legal and regulatory environment. Wealth managers must be agile, informed, and proactive in addressing these challenges to ensure effective and compliant wealth management practices.

Future Trends in Wealth Management

The field of wealth management is witnessing a transformative shift, especially in light of evolving legal landscapes and technological advancements. Industry experts are emphasizing the emergence of several key trends that are reshaping wealth management practices.

One of the most significant trends is the integration of advanced technologies like Artificial Intelligence (AI) and blockchain. AI is revolutionizing wealth management through predictive analytics, personalized investment strategies, and enhanced client service. It offers sophisticated tools for risk assessment, market analysis, and portfolio management, aligning investments with the ever-changing legal and economic environment.

Blockchain technology is also making a substantial impact. Its ability to provide secure, transparent, and efficient transactions is particularly relevant in managing assets and ensuring compliance with legal regulations. Blockchain is not just streamlining processes but also opening new avenues for investment and asset protection.

Another notable trend is the increasing focus on sustainable and ethical investing. As legal frameworks evolve to emphasize environmental, social, and governance (ESG) criteria, wealth managers are adapting by incorporating ESG factors into their investment decisions. This shift is not only a response to legal changes but also a reflection of the growing client demand for responsible investment options.

These emerging trends, backed by technological innovation and a shifting legal landscape, are setting the course for the future of wealth management. They highlight the need for wealth managers to be agile, informed, and technologically adept to navigate the complexities of this evolving sector.

Some FAQs Answered On The Relevant Topic

How does changing tax legislation impact wealth management strategies?

Changing tax laws can significantly impact investment decisions and asset allocations. Wealth managers must continuously adjust strategies to optimize tax efficiency and ensure compliance with the latest regulations.

What role does technology play in legal compliance for wealth management?

Technology plays a crucial role in ensuring legal compliance. Tools like AI and blockchain provide enhanced capabilities for monitoring regulatory changes, managing risks, and maintaining transparent records, thereby facilitating adherence to legal requirements.

How should wealth managers approach international investments amid fluctuating legal environments?

Wealth managers should approach international investments with a thorough understanding of the varying legal environments. This involves staying informed about global regulatory trends, understanding the tax implications, and employing risk management strategies that account for legal uncertainties.

In conclusion, the intersection of wealth management and evolving legal environments presents both challenges and opportunities. Understanding and adapting to these legal changes is paramount in today’s dynamic financial landscape. The increasing role of technologies like AI and blockchain in navigating these legal complexities underscores the need for wealth managers to embrace innovation and continuous learning. Staying agile and informed is crucial for developing proactive wealth management strategies that align with legal requirements and client goals. As the legal landscape continues to evolve, the wealth management sector must remain adaptable and forward-thinking to successfully navigate these complexities and thrive.

Thomas J Powell is Senior Advisor at The Brehon Group with over 35 years of experience in private equity, commercial banking, and asset protection. An international lecturer and policy expert, he specializes in financial structuring, asset strategies, and addressing middle-income workforce housing shortages.